Tax audit

ttorneys with you, every step of the way

Starting with our DIY services doesn’t mean you have to do it all by yourself. Count on our vetted network of attorneys for guidance — no hourly charges, no office visits.

2000+

businesses

Helping entrepreneurs turn ideas into

businesses over 2000+ times in Russia.

1500+

consultations

Providing access to our independent

network of attorneys over 1500 times.

90+

liquidations

Helping companies to close down operations in the smooth way

Why choose us:

We do right by you

We will refund our fee within the first 60 days if you’re unhappy with our services.

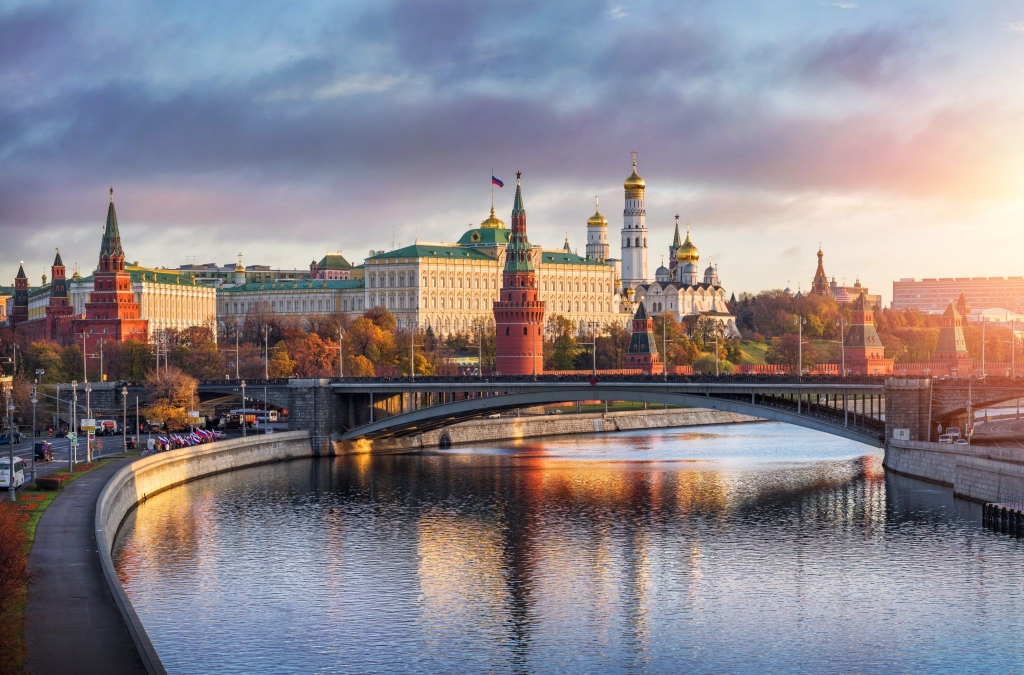

We’ve got you covered in Russian federation, Kazakhstan, Turkmenistan, Turkey and UAE

Have peace of mind knowing our docs have been legally recognized in every state—and you’ll never need to leave home to work with a lawyer.

Flat-rate fees

No hourly charges. No surprises. Really.

Tax audit in Russia

What is that?

Let’s start from the definition. What is that? Often such an audit is ordered before any audits of state authorities, and therefore Tax audit services are among relevant and demanded types of audit services.

The goal of this type of activity is to find the errors in tax accounting documents and develop measures to eliminate these. Usually, those ordering tax audit services are interested in risk-assessment of an enterprise and minimizing them. Tax audit clients receive professional advice on correcting the errors in accounting and reporting documents, and reducing any risks associated with taxes.

Tax audit services from Valen Company

When ordering Tax audit services from us, you can be sure of the professionalism of our specialists and the relevance of their knowledge.

Our lawyers have extensive experience working with both private and large corporate clients. They are well versed in all the intricacies of Russian legislation and will help you get the desired result, pass any test and protect yourself from any possible fines and other unpleasant consequences. This way you get the best price-quality-time-spent balance possible.

You can contact us using the contact form on our website, or by calling us on the phone, by email, or just visit our office in Moscow and ask any question you are interested in life.

| ACCOUNTING AND TAX CONSULTING | |

|---|---|

| Financial outsourcing (keeping accounting records) | from 300 euro |

| Tax consulting | from 50 euro |